- Youre a dynamic services member with at the least 3 months regarding energetic responsibility service.

- You are an experienced who has supported at the very least 181 days from energetic duty service.

- You are a recent Federal Shield representative having supported at the least six ages.

- You are a discharged Federal Guard member who’s supported on the very least six age.

- Youre a nationwide Guard otherwise Supplies representative who has been entitled so you’re able to active responsibility and you may offered 90 days from effective service.

- Youre good widowed and you may united nations-remarried armed forces spouse whose companion possess passed away on type of duty or due to a support-related burns off. (Attempt to offer evidence of their Dependency and Indemnity compensation).

Va Framework Mortgage Credit Standards

The Va build mortgage includes lenient borrowing criteria versus conventional financing, deciding to make the mortgage a lot more offered to experts which have straight down fico scores. This means that experts in place of max fico scores will have the ability to get into Va construction loans.

- 620 Minimal Being qualified Fico scores for all being qualified individuals

- 620-659: No less than 2 being qualified fico scores are needed for everyone qualifying borrowers. payday loan places in Breckenridge Utilize the center score if the step three fico scores or even the lower of the two if 2 credit scores.

- 660+: At least step 1 qualifying credit history is needed for all borrowers.

- A minimal member get of the consumers could be useful for new certification processes.

Va Framework Loan Process

The fresh new Va construction mortgage procedure is relatively straightforward, if you have the help of a great Va mortgage officer who can direct you through each step on the financing process. To get started in your application having an effective Virtual assistant framework mortgage, contact Cover The usa Mortgage now!

Confirm Eligibility and Entitlement

The initial step from the Va design financing process is actually getting their eligibility certificate. You might receive your certificate of qualification with ease by using the COE form toward our very own web site. Our very own access to new LGY program function we can help you get your eligibility certificate in seconds.

Just be sure to register the services of an experienced Virtual assistant bank including Safeguards The united states Mortgage and you may an experienced Virtual assistant mortgage manager to aid guide you from the application for the loan, process and closing of your own Va structure mortgage. In the Cover The united states Financial, i make an effort to make loan procedure worry-totally free. Safety The united states Mortgage also provides Virtual assistant build loans with a hand-with the financing manager and personalized sense for the respected veteran users.

Pick Va-Recognized Creator

You must use the services of an excellent Va-acknowledged builder about Va build loan process. For many who actually have a covered creator planned, contact your Va bank and inquire these to help you get your own builder registered together as well. Brand new Va and financial both approve builders.

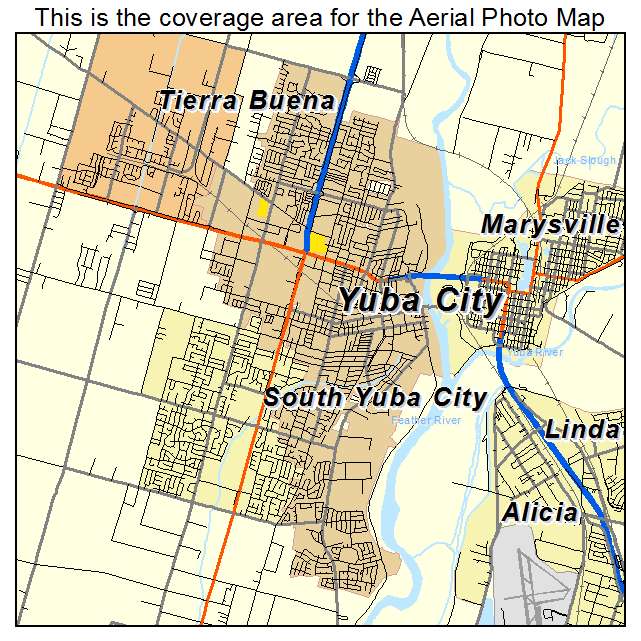

You will find Va-approved developers using the associate-friendly Va-recognized builders map, which will help the truth is a creator in your area. Or, you need the latest Experts Circumstances website to check if an effective creator are entered to the Virtual assistant.

Because a creator is actually inserted for the Virtual assistant cannot mean that we shall accept all of them during the Security America Financial.

Over Property Appraisal

Your bank usually register the help of an appraisal pro during the Va build loan application procedure. The fresh Virtual assistant lender will require an accurate really worth portraying brand new accomplished home’s value, as they can maybe not provide more than which well worth. The brand new appraisal will also help the latest Virtual assistant financial be sure to is not overcharged towards the structure of the home.

Construction

Closure on Virtual assistant construction money can take away from 29-two months to close according to products for example which have builder arrangements, the newest property condition, the newest developers acceptance along with your recognition. There is certainly a differ from 5 weeks as much as an effective seasons to build. 12 months is the maximum invited. Once you have signed toward loan, design will start. You’re not required to make costs with the a great Va build mortgage up until the framework stage is finished along with a certificate out of occupancy.