A question a lot of my personal website subscribers ask is, “Simply how much commonly my personal month-to-month framework financing percentage be?” These are generally seeking to know if they may be able afford to make that commission through its normal domestic commission, whether or not that’s home financing otherwise book commission.

First, according to lender, they may request you to pay the attract month-to-month otherwise every quarter. Either way, you will need to plan for it month-to-month you don’t get astonished of the an enormous every quarter payment.

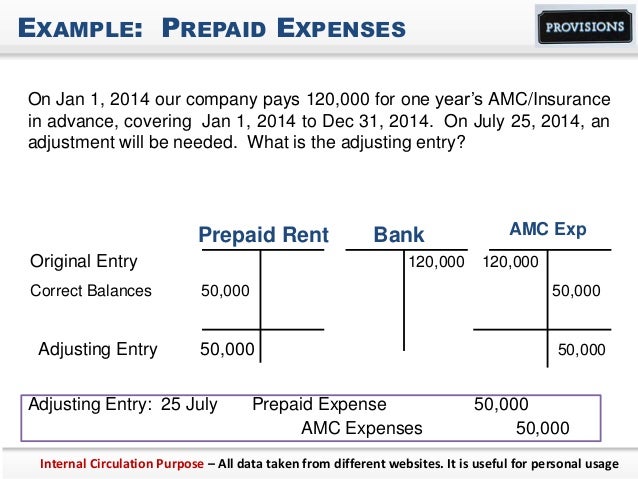

2nd, allow me to temporarily determine how a housing financing functions. It’s a small different from the loan mortgage you will be always if you have ever purchased a property and made payments.

Home loan

Financing buying an existing house comes in you to swelling share. Such as, can you imagine you obtain $five hundred,000 to shop for a home. The financial institution hands the money out over owner in a single lump sum, and also you agree to make month-to-month dominant and you may interest money to the lending company until the loan is repaid. Fairly simple.

Framework Financing

- 1. They funds from inside the values you to definitely about fulfill the price of design because it moves on.

- 2. You do not generate dominant and you may interest money, only notice.

After https://availableloan.net/installment-loans-mi/eagle/ you romantic on the design financing, you’ve not in fact borrowed all money yet ,, thus in the beginning there is no appeal including. Your builder installs brand new plumbing system in slab and pours the fresh slab. You are taking a suck from your own build financing and pay the builder. Then the creator structures the house and you may installs brand new rooftop shingles. You get another type of mark and you will spend the money for creator.

Wearing down Your own Attract Payments

Up until now, let’s say you’ve removed, or borrowed, $fifty,000 of one’s $500,000 design mortgage. What if the rate in your structure loan are 8%. The fresh new 8% is a yearly number , and you can 8 split because of the 12 try 0.67, so that your monthly rate of interest try 0.67%. You have lent $fifty,000 up to now, very 0.67% of the is actually $. That’s going to end up being your attention payment next month.

If the next month your draw an alternative $twenty-five,000, then your desire would be $five hundred, because you are purchasing that 0.67% appeal towards the overall amount you’ve lent so far. The brand new bad week could be the few days between if creator comes to an end our home . You can easily shell out your the very last percentage and you may personal on your permanent mortgage.

When this occurs, you have lent the entire count, which means your payment was 0.67% away from $five-hundred,000, or $3, contained in this analogy. Once you romantic on your own long lasting financial, you to definitely the latest mortgage will pay of the structure financing, and you will probably begin making payments identical to you happen to be used to undertaking.

Construction Financing Repayments Would be Less Humdrum

Listed here is a small secret that may result in the month-to-month interest repayments shorter humdrum. And when your residence appraises for enough very first to keep the mortgage so you’re able to really worth contained in this limits, it’s possible to funds the attention costs.

That just means the financial institution tend to calculate the level of attract you’ll likely owe inside title of build loan and increase the amount of the loan of the one to count. After that, you’ll be able to create a suck against their long lasting mortgage and also make the eye commission.

Yes, you might be borrowing from the bank money to blow attract, but it’s eg a small amount and eg a short period, the other appeal are minimal and might improve difference between strengthening your dream household now and you can prepared up until you’re too old to enjoy it.

The straightforward Description

When you’re doubtful (or is actually a great Dave Ramsey enthusiasts), here is the mathematics. Why don’t we use the example more than the spot where the very first desire commission is actually $. For folks who lent that in the 1st week regarding construction and you may paid down it when you romantic their permanent financing six months later on, might owe half a year interesting at a level regarding 0.67% a month on that $. That’s 0.67% monthly to have half a year into the $, hence adds up to a supplementary $.

Develop one to advice makes it possible to package your budget within the framework process and sheds slightly far more white on which is also become an apparently mystical process.