People that give personal funds to increase a return; A syndicate band of dealers exactly who pool money that are spent towards the a situation-by-case foundation; otherwise, Home loan investment companies exactly who pool capital from buyers or personal loan providers for several fund at a time if the profit meet lending guidelines.

Are Individual Loan providers Managed?

Personal mortgage lenders commonly regulated, which means you have to make sure you may be handling a reputable bank. How you can do that is by earliest working with the best and you can better-linked mortgage broker. A mortgage broker may also be able to reveal how flexible the lending company was.

Specific lenders is actually stringent and certainly will force a property foreclosure otherwise fuel-of-business for people who default towards home financing percentage. Although some be a little more flexible and can work out plans in order to help you keep the home for many who standard to the a payment.

Read the deal away from an exclusive financial very carefully so that you know this new words. You to definitely risky identity that is certainly tucked toward mortgage agreements are this new genuine sale condition. Which clause causes it to be therefore, the best way you might break your own financial is by offering your property.

Along with, look into the history of possible loan providers on line. Specific loan providers you need to stop was employed in court circumstances, fighting consumers for cash.

Just how can Individual Mortgage loans Impression Credit?

An exclusive financial gives the debtor an opportunity to show a good self-confident installment records, that debtor wouldn’t be in a position to have indicated if you don’t if ineligible having home financing away from a financial.

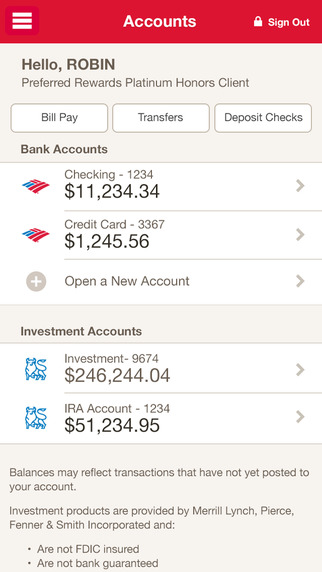

Yet not, payday loan Bantam given that private lenders do not usually report to the financing agency, a personal financial by yourself cannot likely aid in increasing your borrowing get. Meanwhile, specific lenders get inquire observe bank details for the past twelve days to see if you have made your personal home loan repayments punctually, that’s ideal for the repayment background but wouldn’t feeling the credit rating.

Tend to, a personal financial is employed to pay out unsecured bank card loans for example for those who have zero equilibrium on the borrowing credit, they shows the credit reporting department (Equifax and you may TransUnion) you are effective in dealing with currency as well as your credit rating usually go up. Meanwhile, when you have poor credit, often the new financial institutions must personal the playing cards immediately after it receives a commission off. Or perhaps your credit score is so poor if your score an exclusive home loan, you currently have zero effective credit.

If this is the outcome, then a terrific way to raise credit is via taking good protected bank card. A protected credit card is when you give a loan company currency, state $dos,000, and then they offer a credit card with this limitation. Once you have tried it for a little while, and thus enough time as you have generated the required payments and you may that your particular harmony isnt hugging the latest restrict of your own borrowing card, after that your credit history increases.

Consumers are encouraged to enjoys about a couple effective borrowing from the bank points since this is always a significance of loan providers to offer you an educated pricing and words when trying to get a mortgage.

Just how A large financial company Can help you

Lenders helps you weighing your options with regards to in order to borrowing from the bank a mortgage. He’s the go-to help you investment for getting a mortgage services that is ideal for your finances.

Lenders could also be helpful you target and rectify people activities that will be preventing you against being qualified getting a traditional financial. And they’re going to help you produce a plan-known as a leave means-to move of a private home loan so you can a timeless financial after you are prepared.