Well-Known Member

- #thirteen

I paid excess currency with the my personal thread concise in which I essentially paid back the strain count, thus in lieu of making the bucks regarding the bond I withdrew the it and set they on the a money sector account. Very, lets state my personal thread try R1 000 000 I’d R1 030 000 regarding the supply bond. We grabbed aside R25 000, thus i nonetheless were along side loan amount from the R5000, meaning I don’t owe anything. Guess what my monthly debit acquisition ran right up. And so i imagine it is weird as there try no appeal speed improve or some thing also it just went up regarding R200. The following month my debit purchase ran out of as per normal and you will I experienced a great deal more way too much money regarding thread. So i got out more income, not my bond try R-5000 less than the things i owe them. Again the brand new monthly payment went right up. We phoned the home loan office and also they may not know it and told you might get back to me, it never ever did. The following month an equivalent techniques, grabbed the bucks aside following debit order and debit buy ran right up again. Not I was inside excessive once more, thus the house is totally paid but I am purchasing alot more month-to-month.

Educational

At some point bought them once more and expected them once again from the the new expands, as every time I simply take money out quite often not really underneath the thread matter I want to spend a lot more, step 3 expands in a row but basically Really don’t owe them some thing it owe me personally. Lond story small, how come I got would be the fact each time you shell out money to your and take currency out it recalculate the load towards level of days kept to the label. So their tale goes that you could become investing in fact in order to absolutely nothing every month to get to know the termination of label date, incase you either you take money out, lay money in or the interest rate changes the text will get recalculated to be certain by the end of label you’d owe little.

It nevertheless doesn’t make sense in my experience however, We almost tired every avenues discover a description that produces feel. As the how can i feel paying too little just after an excellent desire rate boost, and then they should to alter it but I really dont owe things the moment. It told you an identical manage happens in the event your interest rate alter and they generally rectify the new monthly debit order to fulfill new avoid out-of title day, so fundamentally the total amount your debit order increases or down centered on rate of interest % isnt entirely according to the debit purchase % alter.

Your more than likely made a decision to continue make payment on thread since if that you don’t overpaid. Therefore, installment loans online Oklahoma as the bond are paid up the fresh payment per month is calculated as you are nevertheless using it off into title of the bond. The positive would be the fact your monthly payments are part of the equilibrium, thus no cash is forgotten and capture they aside once again.

If you don’t would like to get troubled like this, after that will have your costs recalculated each time you more spend with the bond.

If only the brand new lump sum payment offered then come in and now have which remedied that have Lender because anything try up or your own resource given that typical repayment is actually wrong.

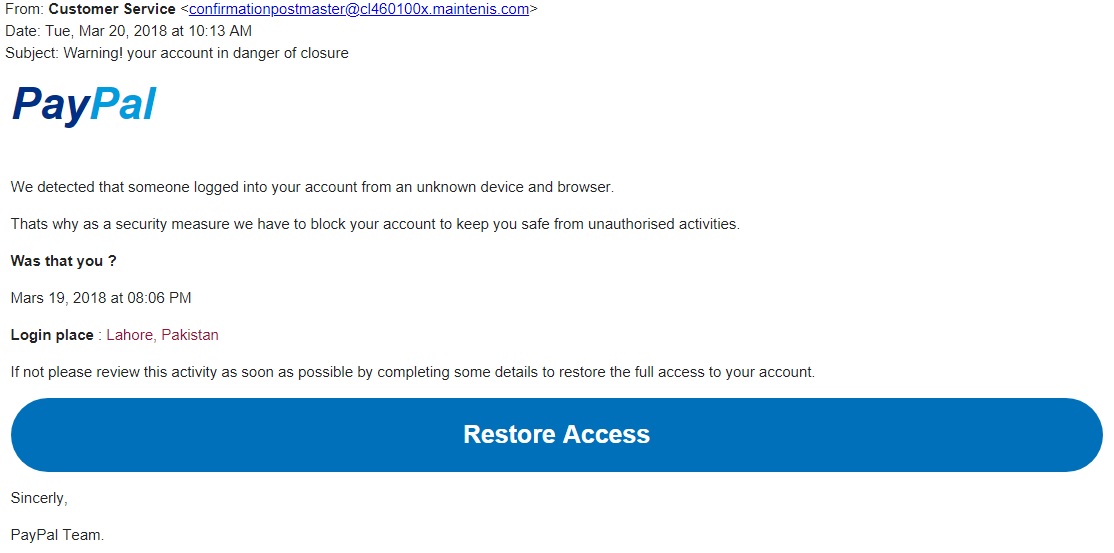

The audience is however arguing the new fairness of vague wording which have Basic Financial and simple fact that every-where the fresh access bond was said written down (web site, banking application), this new wording made use of means zero improvement in this new month-to-month repayment except if the interest rate changes (find picture here).