I am a great Us Financial consumer and in case I-go in order to refinance in identical lender, do they charges closing rates or perhaps not? Other banks eg Wells Fargo and you will Quicken Money would not charges their clients closing costs if they refinance together. I want to score a no closure cost refinance mortgage mortgage. Must i score a no closing prices re-finance with our company Lender when the I’m a consumer? I would like an inexpensive home mortgage refinance loan financing.

I recommend your consult all of us lender and inquire them when the they might charge settlement costs to refinance your house. you ought to just remember that , it will cost a lender so you can re-finance home financing, while they could possibly get state “no settlement costs.”

The very first is a profile of us Bank financial and refinance vendor that we performed. The second is a link where you can submit an application for 100 % free to own a beneficial re-finance quotation: home loan re-finance quote.

Usually your own rate of interest become higher?

When a lender claims that there might be no settlement costs, they generally provide the borrower a high interest. Below i am able to define exactly what a zero-cost mortgage re-finance are.

Sadly, a no-costs home loan isn’t really decreased along side future. In place of purchasing fees out-of-pouch, closing costs, and other will cost you at the time of the borrowed funds, the interest rate is actually .25 to help you .5 percent large to purchase lender’s costs and you may any third-class charge lenders guarantee you are not using. The lender isn’t really offering some thing away free-of-charge.

- no situations, however you shell out lender costs and 3rd-team costs

- zero bank charges, but you pay third-people charges

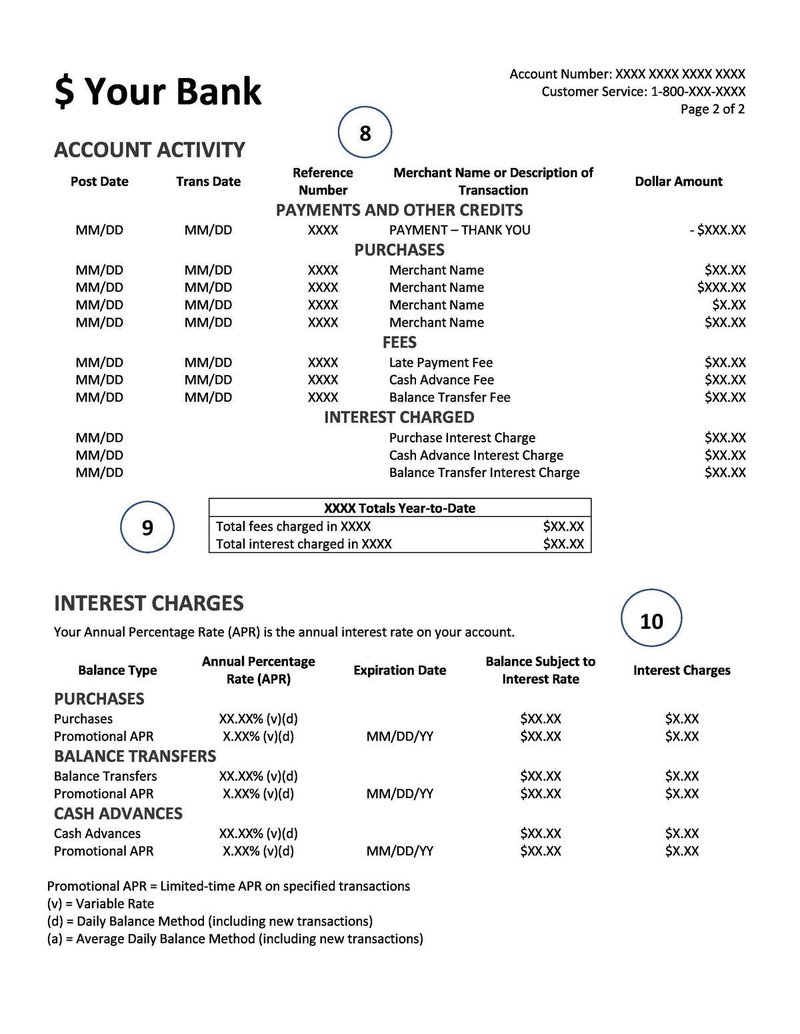

- no money up-side, but every charge and you will prices are included towards loan’s interest

A real zero-costs home loan might have an identical interest while the other financing with no costs to your lender or third parties.

These types of financial is the best for those who want to sell otherwise refinance in some ages. In the event the rates is actually continuously losing, then you can change from no-pricing re-finance to another zero-costs re-finance instead paying a penny to your settlement costs. If you would like stay in your house and never re-finance once again, then the high rate of interest can cost you furthermore the latest life of the borrowed funds.

For people who propose to stay-in their houses for lots more than 5 years and do not decide to re-finance once again, an educated choice should be to save up the bucks to fund the new settlement costs and you may charges on your own mortgage and now have a down interest rate. It does not appear to be much, nevertheless difference in 6.25% and you can 6.5% really can add up. Towards a good $100,000 mortgage reduced over three decades, one totals $6,000 much more into the focus.

Understandably, such financing are almost impractical to pick

If not intend to offer otherwise refinance when you look at the about three-to-5 years and your settlement costs was lower than the extra appeal, most likely they are, then it’s worth every penny to spend the brand new settlement costs in advance. Even factoring in your tax deduction, paying the closing costs do nevertheless save you money over the long-label. The greater the mortgage harmony, more one more quarter area will cost you.

there are these types of mortgage loans at the most loan providers. bills can also be hook one numerous no-rates lenders. there are also all of them at the most significant banks and you may mortgage lenders. to cease are overcharged to suit your home loan, contrast their attention cost immediately after which look for every single possible financial lender’s product reviews and you may comments from customers toward individual internet as well as the brand new top company bureau’s website.

no cost mortgage refinancing are a greatest way to take advantage from dropping rates. attempt to refinance to a lower price and you can spend brand new settlement loans in Salmon Brook costs ahead of you to definitely even more desire very actually starts to add up.