Try a beneficial 35-Seasons Mortgage Term the brand new Regular?

It’s treat to discover that delivering onto the housing ladder continues to be demonstrating as a struggle for some do-become basic-date buyers. We’ve got read prior to now the Financial of Mum and you can Father seems becoming an excellent source of fund having some people. Yet not, latest reports suggest people looking to buy the earliest assets is actually seeking to expanded mortgage loan periods, as well.

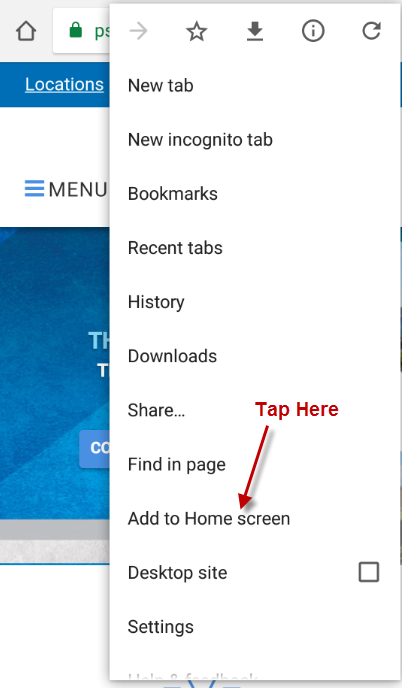

Figures revealed about Large financial company Ltd reveal that the amount of men and women taking out fully an excellent Uk financial more than a beneficial thirty-five-year term have twofold in prominence over the past 10 years. In past times, merely eleven% out-of consumers within this classification selected a phrase so it a lot of time. Now, it’s trebled to help you 33.2% away from first-day consumers.

The typical financial name has enhanced

A 25-seasons financial name used to be the high quality length of home loan very consumers create opt for. It offers now altered plus the average label is around 27 many years. With quite a few the latest customers interested in challenging to locate a fair offer, you payday loan Greenacres to clear option is to extend the life span of financial in itself.

The brand new pattern is also present in the enormous drop from the percentage of consumers that plumped for more-common twenty-five-12 months title.