Therefore we continued to enhance due to the fact a lender and you can expand inside property, finance, and you may places

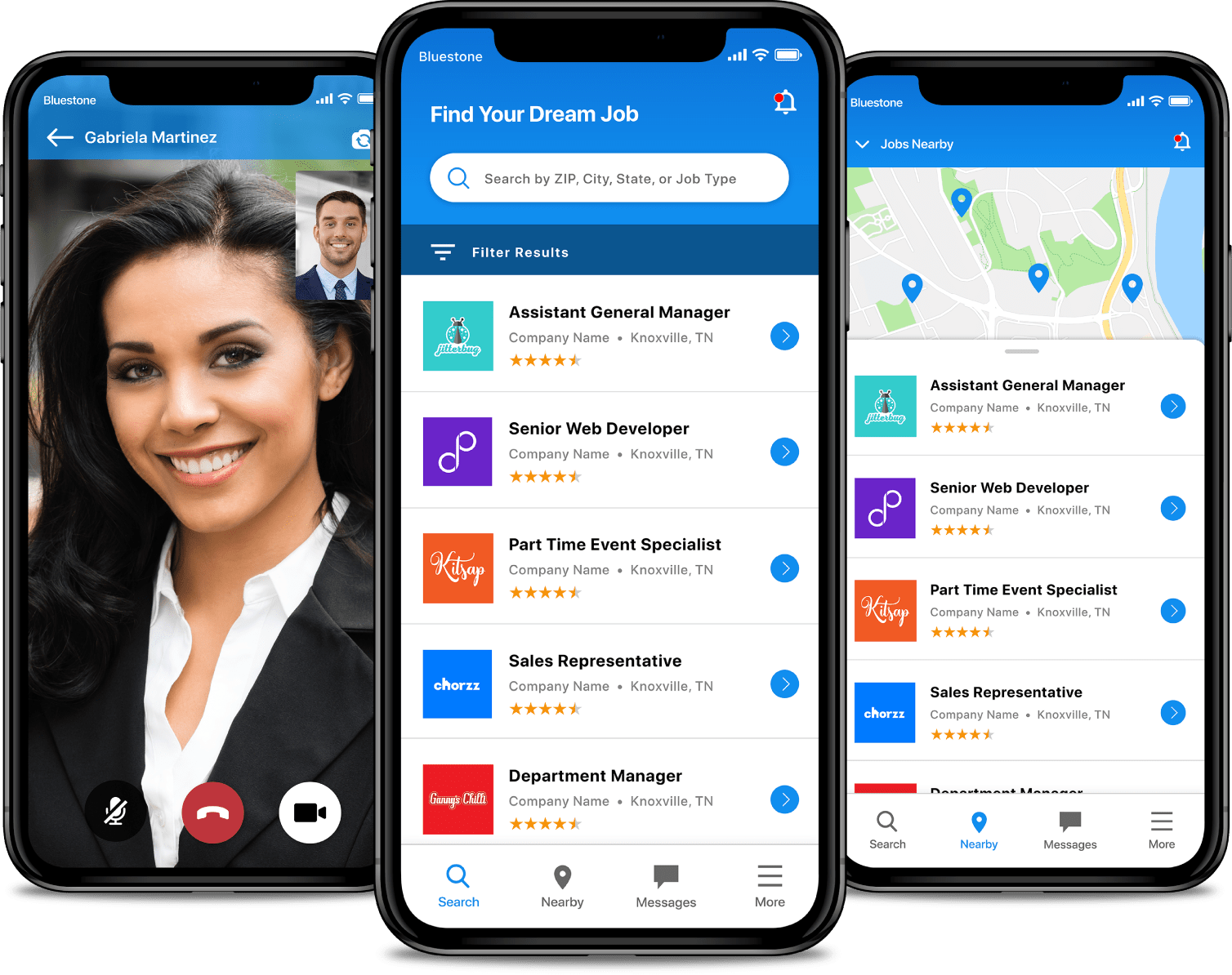

We have a fully useful cellular software, in order to pull up their profile to your New iphone, apple ipad, and other devices, and check your lender balances, pay bills, and also make dumps

We continue to have on the six away from 10 panel players which are generally educators otherwise are associated with the training. Merely 20 so you can 30 percent of one’s membership now was involved on informative techniques; almost all of the membership isnt. It’s drawn our panel prolonged in order to transition because i’ve longtime panel players.

That anticipate us to look after a job and even incorporate staff throughout one to entire time

We were sense a time period of progress entering the brand new market meltdown-so we got one or two uncommon years in which we increased during the a 20 percent clip-nevertheless the recent years we have been averaging probably 8 percent growth. This present year we budgeted closer to eleven %. I’m not sure if the we’re going to strike you to definitely mark this season. Credit is a bit at the rear of all of our brand spanking new forecast out-of everything we consider it would be prior to around.

JOHNSON: I have a complete cluster of men and women from a couple additional divisions, plus They cover group which display screen our expertise 24/seven, to be certain we do not has actually intrusions. You’ll find ongoing efforts to your protection day-after-day having spam and you can email address and other kind of breaches.

We also have an alternate class of people inside our fraud company, also it can not be that the bad guys is actually fighting STCU but alternatively they’re attacking members’ account as a result of public technology otherwise by various other form.