This files required depend on the sort of home loan household financing

While the we have said, underwriters evaluate your bank account, credit score, and possessions you should buy to choose the lender’s risk top to choose whether or not to agree the loan application. When you look at the underwriting process, underwriters remark three critical section, called the step 3 C’s regarding underwriting. They’re:

Capability

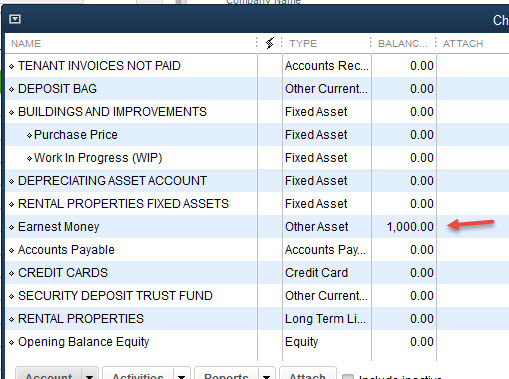

Capabilities ‘s the capability to pay-off a loan according to items such as for example a position record, earnings, personal debt, and you may possessions such as for example coupons and you can investment.