Family collateral financing: All you need to see

What is actually a property collateral mortgage? Can you use a property guarantee mortgage to own something? Learn more about so it by the understanding the article today

- What exactly is a home guarantee mortgage?

- What is the difference between a home loan and you will a property collateral loan?

- How does getting a house security mortgage work?

- What’s the disadvantage off a home equity financing?

- Seeking property equity loan getting things?

Because of its autonomy, a house guarantee mortgage makes it possible to in just about any level of ways, off paying down a student loan to help you resource renovations to bolstering a crisis fund. Like any almost every other financing, but not, a house security mortgage may also have downsides.

Let me reveal all you need to find out about a house guarantee loan: The goals and should you use they. for our usual audience off mortgage professionals, this really is section of all of our buyer education show. We prompt one to ticket it together to clients exactly who can get features questions about home guarantee fund.

What’s property security loan?

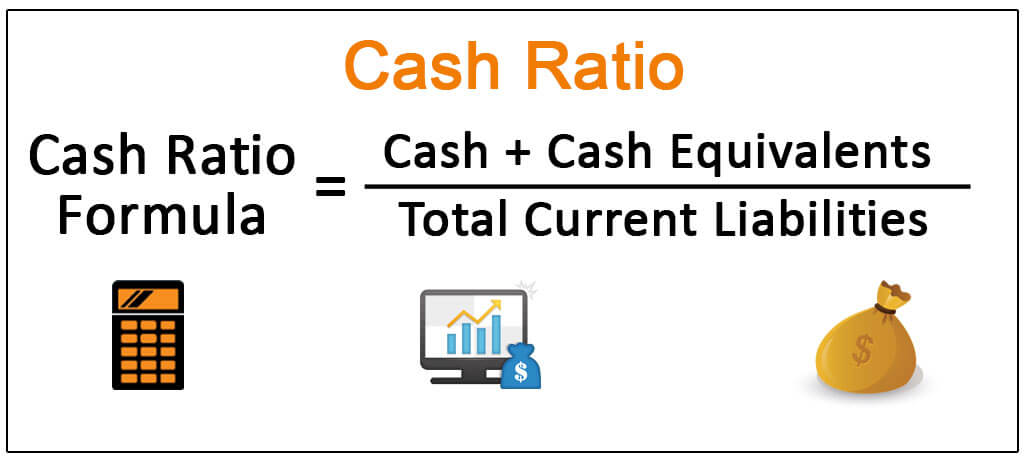

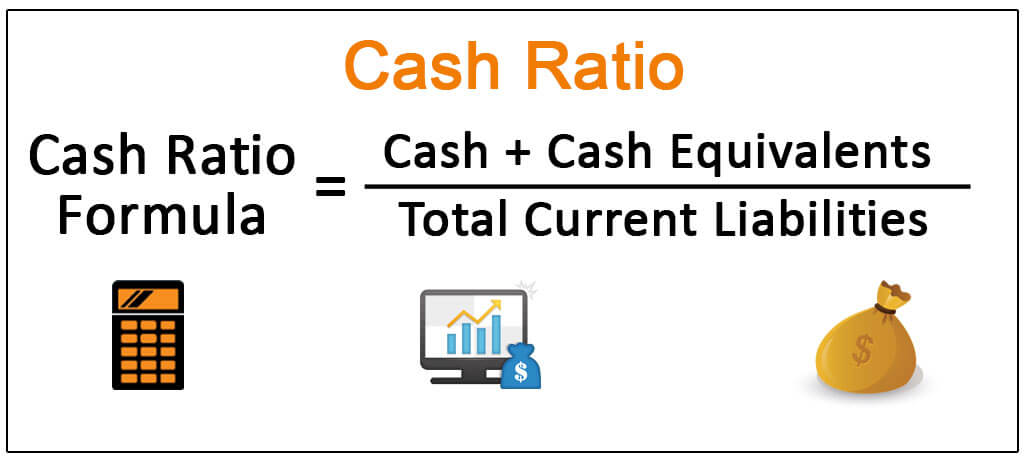

A property equity loan-known as the next home loan, a collateral financing, Westgate loans otherwise property-guarantee fees financing-is actually a loan you are taking aside resistant to the value of your own home. Domestic guarantee ‘s the portion of your house that you have paid off, we.e., your share in the home in place of the lender’s. Household security are, this means, this new appraised value of your house minus any a fantastic mortgage and you may financial balance.

You could potentially sign up for a home guarantee loan for all the matter out of factors, but they are usually used to let safe money having good home restoration, in order to consolidate loans, or to advice about another financial needs. Available for each other low-residential and you may homes, the mortgage count having a home collateral loan was computed by the the modern market value of the house.