KeyBank Now Providing Investment Alternatives for Are created Belongings

Plus the money solutions, the newest are available domestic is eligible for KeyBank’s Special-purpose Borrowing Programs to support closing costs and you can prepaid charge

Having brand new choices to fund are formulated property, KeyBank try then committing to putting some path to homeownership convenient and fair

CLEVELAND , /PRNewswire/ — Now, KeyBank (NYSE: KEY) announced the capital options for are manufactured home as a part of Key’s dedication to growing sensible device choices regarding the organizations we serve. Financing choices are available for purchase, including rates/title and cash-away refinances. To qualify, the brand new are available domestic must:

- Getting a multiple-large and you can permanently attached towards ground;

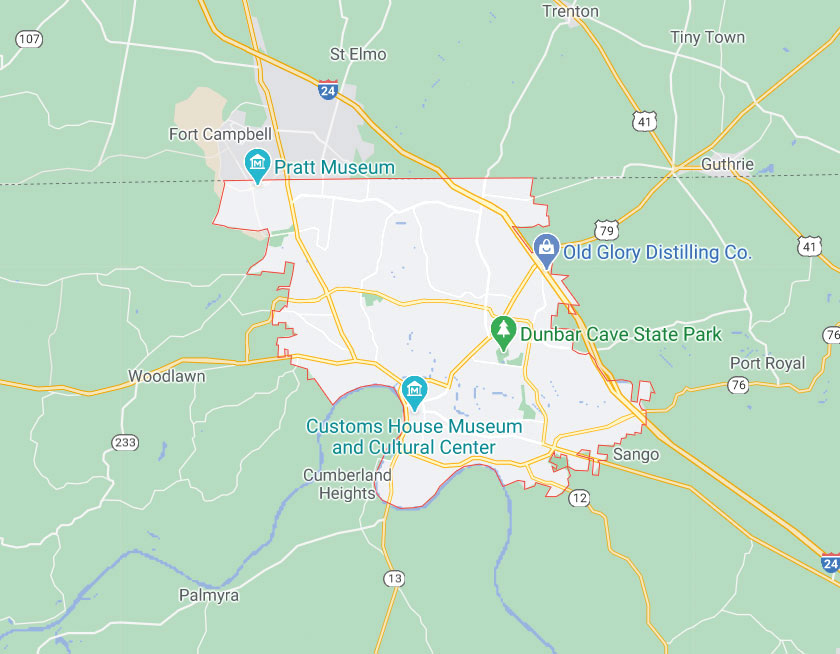

- Be in qualified components within this KeyBank’s footprint (unavailable into the Ny, MA, CT, FL) and you can titled because real estate;

- Enjoys HUD research plate and you will HUD certification name; and

- End up being an initial or secondary family.

“KeyBank are invested in decreasing the barriers to help you homeownership as a consequence of sensible lending products and you will characteristics, educational assistance, and you can lead capital,” told you Dale Baker , President regarding KeyBank Domestic Credit. “Owning a home are a beneficial foundational action to strengthening an extended-identity financing approach. These types of the fresh are designed a mortgage choices are the next phase KeyBank are getting to do all of our part in assisting our very own subscribers go their imagine owning a home and you will proceed to their monetary travel.”

- Reasonable financing services apps susceptible to income criteria, possessions venue, otherwise military status. Readers could possibly be eligible for lending assistance, that mitigate costs and permit them to place the money spared with the other necessities.